Contents

Inflation continues to be a dominant force shaping global markets in 2025, influencing monetary policies, consumer behavior, and investment decisions worldwide. As countries grapple with varying inflation rates, the interconnectedness of economies creates ripple effects that market participants must understand to navigate this dynamic landscape successfully.

Current Inflation Landscape: Divergence and Moderation

Global inflation shows a mixed picture. While inflation has moderated across much of the world, the United States experiences persistent “sticky” inflation above the Federal Reserve’s target, largely driven by tariff-related cost pressures and strong consumer demand. In contrast, many European economies are witnessing a steady decline in inflation, with European Central Bank (ECB) policies aimed at easing rates cautiously to support growth amid softening wage pressures.

Emerging markets show varied inflation trends—some countries like Brazil and Colombia are benefiting from declining inflation and look poised for monetary easing, whereas others like Russia continue to face high inflation rates above 9%, driven by geopolitical tensions and supply-side constraints.

China maintains one of the lowest inflation rates globally at around 0.5%, reflecting subdued domestic demand and supply imbalances despite positive export growth.

Inflation’s Influence on Monetary Policies and Growth

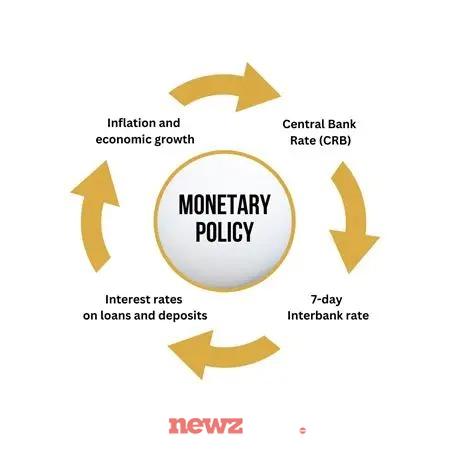

Central banks worldwide are cautiously easing interest rates after aggressive hikes in 2022–2023 targeted at taming inflation. The easing process varies depending on regional inflation dynamics and growth prospects. For example, the Bank of England is taking a gradual approach to cuts, balancing inflation concerns with labor market weakness.

Monetary policy remains a critical lever impacting market sentiment and investment flows. The anticipated moderation of inflation in most regions is supporting a synchronized, albeit slower, global growth forecast of around 1.4% annualized in the latter half of 2025

Impact on Equities and Commodities Markets

Inflation affects corporate profitability through cost pressures and wage inflation, influencing equity valuations. High inflation and interest rates often compress price-to-earnings ratios, particularly in interest-sensitive sectors. Conversely, sectors like consumer staples, energy, and utilities tend to perform better during inflationary periods due to steady demand and pricing power.

Commodity markets are highly sensitive to inflation and geopolitical uncertainties. Energy prices, for example, have experienced volatility linked to Middle East tensions and supply chain disruptions. However, broader energy inflation in OECD countries recently turned positive after months of decline, reflecting recovering demand.

Currency and Bond Market Reactions

Inflation differentials drive currency movements as investors seek countries with stable purchasing power. The U.S. dollar remains relatively strong but faces pressure from divergent global inflation outcomes and central bank policies.

Bond markets respond to inflation expectations through yield adjustments. Rising inflation erodes bond returns, leading investors to demand higher yields. Inflation-linked bonds and shorter-duration debt instruments are popular hedges amidst this environment.

Consumer and Business Behavior Changes

Rising prices alter consumer spending by curbing discretionary purchases and shifting demand toward essentials. Businesses face pressure to manage input costs while maintaining margins, often resulting in price adjustments, efficiency drives, and supply chain realignments.

-

Investors may consider inflation-protected securities, commodities, and quality dividend-paying stocks with pricing power.

-

Businesses should monitor supply chains, adjust pricing strategies prudently, and hedge risks where possible.

-

Policymakers focus on balancing inflation control without stifling growth, maintaining communication clarity to anchor market expectations.

In summary, inflation trends in 2025 reveal a complex global tableau marked by regional divergences, cautious monetary easing, and evolving market implications. Understanding these dynamics empowers investors, businesses, and policymakers to make informed decisions amid ongoing economic shifts, ensuring resilience and opportunity in an inflation-impacted world.