newznew (Auto) : We spend so much time in finding ‘that’ car which also becomes the reason of envy of our neighbours (or at least we wish it to be!). But when it comes to car insurance, most of us know little about it. To help you, here’s a complete guide to car insurance—it includes everything you’ve ever wanted to know:

The concept of car insurance

The car insurance value depends on the IDV— Insured Declared Value of a vehicle. It is the maximum amount that the insurer agrees to pay to the insured at the time of loss. Roughly, it is equal to the market value of a vehicle. So, when you purchase a new car, the IDV is maximum as it is computed on the basis of the showroom’s listed price.

IDV= {Manufacturer’s listing price-Depreciation} + {Cost of Accessories that not included in manufacturer’s listing selling price-Depreciation}

Remember: Every year, your car depreciates and it decreases its IDV as well.

Here is the depreciation table, followed by insurance companies in India:

| Age of a vehicle | % depreciation to arrive at IDV |

| Not above six months | 5% |

| Between six months and one year | 15% |

| Between one year and two years | 20% |

| Between two years and three years | 30% |

| Between three years and four years | 40% |

| Between four years and five years | 50% |

| Above five years | Mutually decided by the insurer and policyholder |

To save money, some people quote lower IDV, however, it is not advisable because even though you pay less, you would have to shell out money from your pocket at the time of claim. Similarly, there is no need to declare a higher IDV because the insurer will consider the age of the vehicle and depreciation rate before settling the claim. Further, the policy will help you only if it is active. Working on the concept of ‘use it or lose it’, you will have to pay a yearly premium to get the car insurance coverage. So, without any delay, renew your policy on time.

What is included under a car insurance policy?

Mainly, a car insurance policy includes the following: –

- Third-Party Insurance: As the name, itself says, it covers losses or damages caused to a third-party by your vehicle, unless stated otherwise. Here, the third-party can be:

- Pedestrians

- People in the other vehicles

- Other vehicles

Points to note:

- It is mandatory to have a third-party insurance to ply your vehicle on a road

- It doesn’t cover any loss or damage caused to your vehicle

So, that brings us to another question— how can you ensure that your vehicle is insured and damages are covered in case something goes wrong? The answer is—

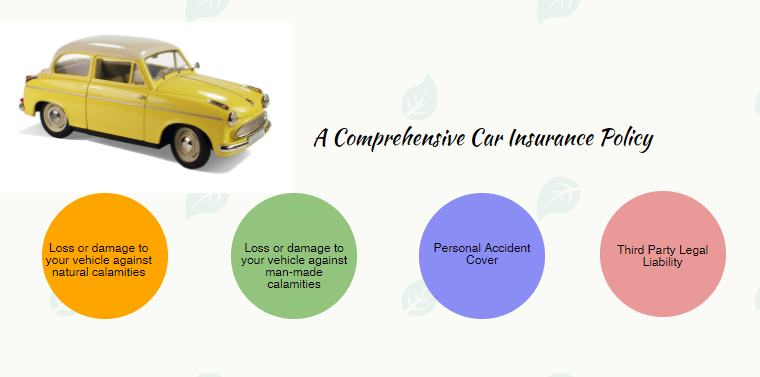

- Comprehensive Car Insurance: – It offers you third-party liability insurance cover, which is mandatory as per IRDAI and covers the losses or damages caused to your vehicle from both man-made and natural perils.

For instance, last month, I bought a car and got it covered under a third-party insurance cover. It means, if God forbid, I bump into some other vehicle, damages caused to the other vehicle will be covered. No loss or damages to my vehicle will be covered. Oops!

However, if I have a comprehensive car insurance, the policy will cover the third-party losses as well as loss or damage to my vehicle.

What exactly is No Claim Bonus (NCB)?

It means, if there is no claim in a policy year, the insurer rewards the policyholder in the form of No Claim Bonus (NCB), which entails into a low premium amount. The best part is that, it keeps on increasing every year.

NCB Rates

| For all types of vehicles | % discount on own damage premium |

| After one claim-free year | 20% |

| After two consecutive claim-free years | 25% |

| After three consecutive claim-free years | 35% |

| After four consecutive claim-free years | 45% |

| After five consecutive claim-free years | 50% |

Source: India Motor Tariff

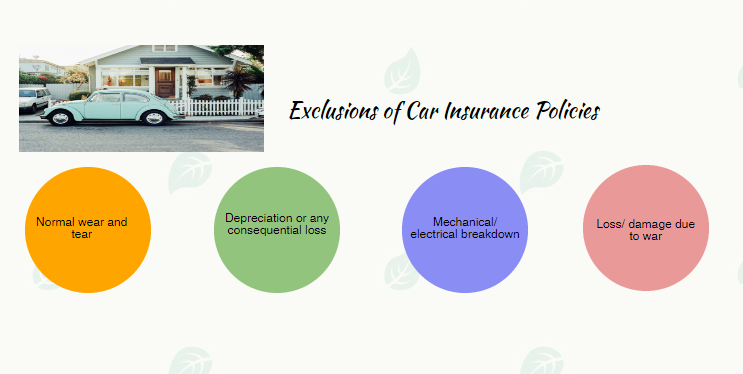

What is not covered under a car insurance policy?

Your insurance policy offers comprehensive coverage to protect you from all types of losses or damages, however, there are certain situations which are not covered in your policy.

How to expand coverage?

Usually, the structure of a car insurance policy remains fixed, but what differs is riders which you can add to your main policy to expand your cover. Here are some of the car insurance riders which you can add to your policy:

- Zero Depreciation Cover : – The insurance company settles the claim after factoring in depreciation. It means even if you have a comprehensive cover, you will not get the complete claim amount. However, if you have a zero depreciation rider, you can expect to get the full claim amount without deducting depreciation.

- Engine Cover Rider : The cost of repairing an engine can run in lakhs, however, if you have this rider, the insurer will cover losses or damages caused to your engine due to water stalling, oil leakage, etc.

- Roadside Assistance and Towing Rider : The insurer offers a bouquet of services to help you in case your car breaks down or meets with an accident. Some of the services covered under this rider are, fuel refueling, lost key recovery, battery jump start, etc.

- Vehicle Replacement Cover : In case your vehicle gets damaged beyond repairs or meets with an accident, this rider compensates you with an amount which would be sufficient to replace your old vehicle with a new one.

- Garage Cash Cover : If your vehicle has been sent to garage for repairing, managing without one can be daunting. Either you would need to carpool or take public transport. In both the cases, you will have to incur heavy expenses. However, if you have a garage cash cover, the insurer will pay a fixed amount which you can use to deal with the daily commuting expenses.

- Ambulance and Medical Expenses Cover : The insurer will cover expenses if you or another party are hospitalised after an accident.

- Personal Accident Cover : It offers financial coverage to your family in case of permanent disability or untimely demise due to an accident.

A word of caution

All aside, you should know what your car insurance policy covers to get the complete coverage. In addition to this, buy car insurance online to save both money and time. And above all, drive safely!